The credit card industry is one of the most profitable and complex financial sectors in the world. Credit cards are used by billions of people for everyday transactions, allowing them to make purchases without needing immediate cash.

However, behind every credit card swipe, there is a vast network of financial institutions, payment processors, and businesses that profit from the system. This article explores how the credit card business operates and who benefits financially from it.

Credit Card Market Size, Trends, and Key Statistics in Canada, the U.S., and Globally

The credit card industry is a significant component of the financial sectors in Canada, the United States, and globally. Understanding the market size in these regions provides insight into consumer behavior, economic trends, and the financial health of households.

Canada

In Canada, credit cards are a prevalent payment method. As of 2025, there are more than 100 million credit cards in circulation, with over 83.4% of Canadians aged 15 or older owning at least one credit card. This represents the highest percentage of credit card ownership globally.

In 2023, credit cards accounted for 33% of total payments in Canada, surpassing debit cards, which stood at 30%. The Canadian card payment market experienced a growth of 7.7% in 2024, reaching a total value of CAD 1.2 trillion. Visa dominates the Canadian market with a 58% market share.

United States

The United States has a substantial credit card market. As of the third quarter of 2024, Americans’ credit card debt reached $1.17 trillion, with balances increasing by $24 billion. Despite this rise, delinquency rates have slightly decreased to 8.8%, down from over 9% in the previous quarter, indicating potential relief as inflation eases.

In 2023, Americans charged $6.22 trillion to their Visa cards, making it the largest card processor in the United States. Mastercard followed, with consumers charging $2.59 trillion to their cards.

Global Perspective

Globally, the credit card industry is dominated by a few major players. Visa, UnionPay, and Mastercard process 96.8% of all credit card transactions worldwide. Visa has 4.48 billion active cards globally, while Mastercard has 2.94 billion. The four major U.S. processors—Visa, Mastercard, American Express, and Discover — facilitated $24.1 trillion in worldwide consumer transactions in 2023.

These statistics highlight the extensive reach and influence of credit cards in modern economies. While they offer convenience and purchasing power to consumers, the associated debt levels underscore the importance of responsible credit management and the need for financial literacy to navigate the complexities of credit usage.

How the Credit Card Business Works

At its core, the credit card business involves lending money to consumers and processing payments between buyers and sellers. When a customer uses a credit card, the transaction goes through multiple steps before the merchant receives the payment. The key players in this process include:

Cardholders – Individuals or businesses that use credit cards for purchases.

Merchants – Businesses that accept credit card payments in exchange for goods and services.

Issuing Banks – Issuing banks are financial institutions that provide credit cards to consumers and extend credit lines.

Acquiring Banks – Acquiring banks that work with merchants to process credit card transactions.

Payment Networks – Payment network companies such as Visa, Mastercard, American Express, and Discover that facilitate transactions between issuing and acquiring banks.

Payment Processors – Payment processing companies that manage the technical side of credit card transactions, ensuring payments are securely processed.

Each of these entities plays a crucial role in ensuring credit card transactions are smooth, secure, and profitable.

Who Makes Money in the Credit Card Industry?

Several entities generate revenue from the credit card business, each earning money in different ways:

1. Issuing Banks

Banks that issue credit cards to consumers make money primarily through:

Interest Charges – If a cardholder does not pay off their balance in full each month, the bank charges interest on the remaining amount. These interest rates are often high, making it a major source of income.

Annual Fees – Some credit cards come with annual fees, especially premium cards offering rewards and perks.

Late Fees and Penalties – Banks charge fees when cardholders miss payments or exceed their credit limit.

Interchange Fees – Banks earn a small percentage from every transaction made with a credit card.

2. Acquiring Banks

Merchants work with acquiring banks to process credit card payments. These banks earn money through:

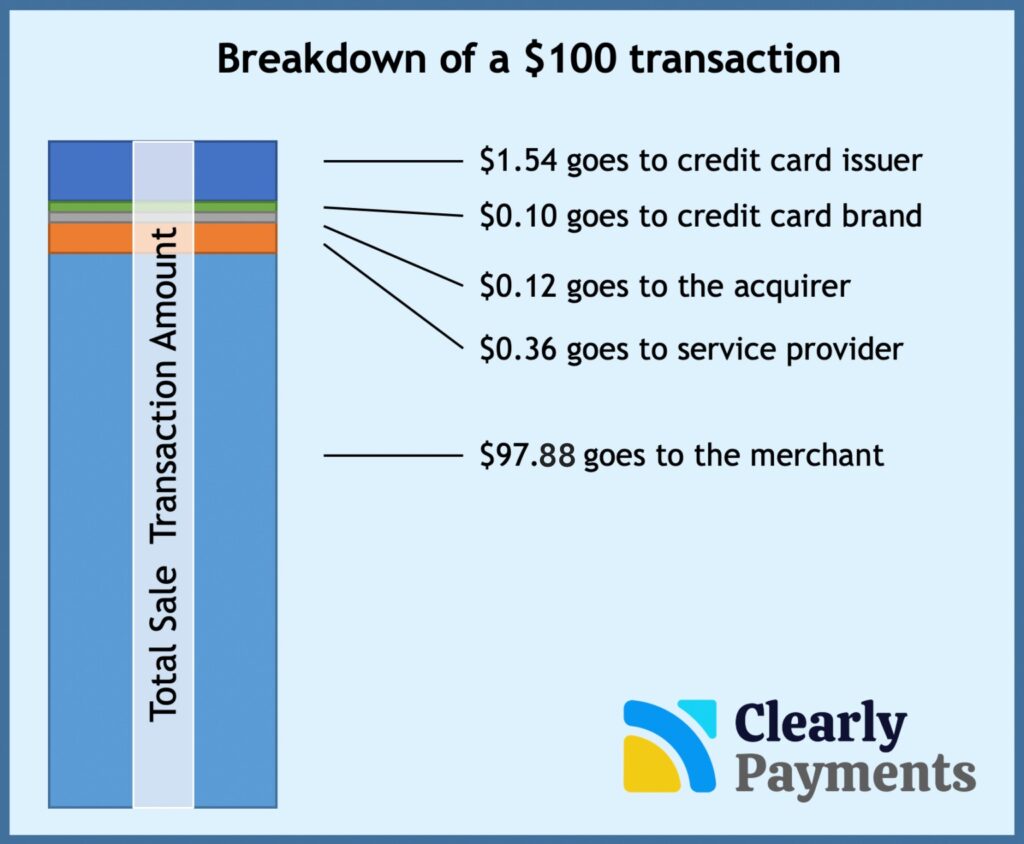

Merchant Discount Fees – A percentage of each sale is deducted as a processing fee, which is shared between acquiring banks, issuing banks, and payment networks.

Account and Setup Fees – Some banks charge merchants setup and monthly fees for maintaining their accounts.

3. Payment Networks (Visa, Mastercard, etc.)

Visa, Mastercard, American Express, and Discover do not lend money to consumers but facilitate transactions between issuing and acquiring banks. They earn revenue through:

Transaction Fees – Each time a credit card is used, a small fee is charged to the merchant.

Licensing Fees – Banks pay fees to use these networks for issuing credit cards.

4. Payment Processors

Companies such as PayPal, Stripe, and Square handle the technology behind credit card transactions. They charge:

Processing Fees – A small percentage of each transaction is taken as a fee.

Additional Service Fees – Payment processors offer fraud protection, chargeback management, and other services for extra fees.

5. Merchants (Retailers, Online Stores, etc.)

Although merchants pay fees to accept credit cards, they can still benefit indirectly:

Increased Sales – Accepting credit cards can attract more customers and lead to higher transaction amounts compared to cash sales.

Loyalty and Rewards Programs – Many merchants partner with banks to offer co-branded credit cards, earning commissions and encouraging repeat business.

The Costs for Consumers

While businesses make money from credit cards, consumers often bear the hidden costs, including:

High Interest Rates – If balances are not paid in full, interest can accumulate quickly, leading to long-term debt.

Fees and Charges – Annual fees, late payment fees, and foreign transaction fees can add up.

Risk of Overspending – Easy access to credit can lead to financial trouble if not managed properly.