The growth of eCmmerce has transformed the retail landscape over the last two decades. But in 2025, how many online stores are there in the United States? The short answer: millions. The long answer is more nuanced. In this article, we’ll unpack the real numbers behind U.S.-based online stores, explore

There is a long history of retailers or financial institutions providing credit for customers. In the 1800s and early 1900s, imagine going into your local

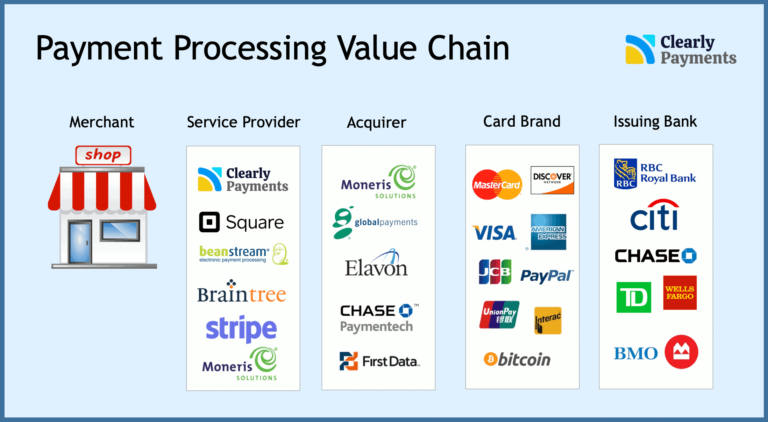

The payment processing industry is a sector of the financial industry that handles electronic payment transactions. It includes companies that provide payment processing services, such

It’s been a decade long trend. People are using cash less in favour of credit card and debit card payments. It’s a trend that will

Chargebacks can have negative implications for merchants. They result in financial losses as the revenue from the sale is lost along with associated fees. Dealing

A return policy is a must. Whether you allow returns or you don’t, a policy should be clear. There are statistics out there that around

When you’re in payments, you’re in an industry with thousands of competitors in a complex value chain. In fact, most of the industry involves just

Future delivery is an important situation for some merchants in payment processing. It’s good to know how to deal with it and your payment processing

Payment aggregators (aka third-party processors) are service providers that allow other businesses to accept credit cards without having to set up a merchant account. They

Billing cycles are one of the most important components that payment processors use to determine the risk level of a business. They determine the risk

It has happened to many businesses before and it’s not a good experience. You are halfway through a busy day and a colleague tells you

The quick answer is yes, you need a merchant account if you are going to accept credit card payments from your customers. A merchant account

If you know why consumers do chargebacks, you can work on preventing them. Chargebacks are one of those things that you should pay attention to

You want to get an understanding of how people are paying for things. Here’s a set of stats to give you the lay of the

Contactless payment is when a consumer taps their card on the payment terminal (point-of-sale, POS) to authorize a transaction. There’s no PIN, no signature. It’s

As a merchant, you need to know there is a difference between the merchant fees of credit cards vs debit cards. In the end, credit

It costs money for a business to accept credit cards. It would be nice if it was free, but it isn’t. The cost is generally

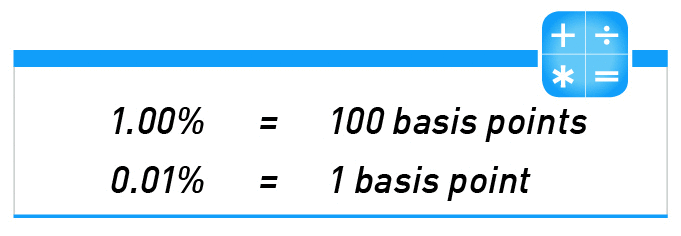

The credit card processing industry has some of the most complex pricing of any industry. To make it more difficult, the industry is so competitive

Payment processors and ISOs (Independent Sales Organizations) mostly sell the same products and services. In the end, ISOs resell products and services from processors and

When getting a merchant account, many payment processors will ask for a personal guarantee. There are some cases where this may not happen, for example

There are a number of different methods that payment processors charge for credit cards. Behind these pricing methods are costs which vary depending on numerous

It’s important to have both values and principles in your business. It allows you to build a strong culture and therefore wield the benefits of

Copyright 2025 Clearly Payments Inc. | Privacy Policy

Clearly Payments is a payment processor in Canada. The Clearly Payments name and logo are trademarks of Clearly Payments Inc payment processing in Vancouver, Canada. The Interac name and logo are trademarks of Interac Inc Canada. The Visa, MasterCard, and AMEX logos are trademarks of Visa International, MasterCard International Incorporated, and American Express Company. Clearly Payments is a Registered Partner/ISO of the Canadian Branch of U.S. Bank National Association.